VAT Increase

Following the introduction of the 5% VAT rate in 2020, as of the 1st October 2021, Hospitality businesses ' VAT rates will increase to 12.5%. This incremental increase and not an immediate return to 20% has been introduced to minimise the impact of returning to the full rate of VAT, whilst businesses are still recovering and returning to pre-pandemic levels of sales and bookings.

This increase will last for 6 months and a return to the full 20% VAT rate will come into effect on the 1st April 2022.

How Do I Change the VAT Rate in Till Tech

We will automatically update all of your products that are set to the default VAT rate, up to 12.5%. Really there is nothing you need to do or worry about from a Till Tech point of view.

However, it is definitely worth checking to see if you have entered in any custom VAT rates on your products. If any of your products have a numerical number in the VAT field, then these products will not be updated.

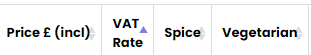

You can find out easily if you have any products with a custom VAT rate:

1. Go To Menu / Shop

2. You will now see a list of your products. Click on the heading VAT Rate until the arrow is pointing up

3. This will bring all products with a custom VAT Rate to the top of your list. If any of the products should be default VAT, and they have a figure in this box, you can edit the product and remove the number in the “VAT Rate” field and click SAVE

Bulk Update VAT Rates

1. Click on Menu / Shop

2. Click View Products

3. Click Set VAT Rates

4. Choose the rate you want to set then click the drop-down and select the products you want to apply at that rate

What Else May I Need To Consider?

Any software you utilise for accounting will also need to be updated. With some software packages, you yourself may need to create a new VAT Rate code. Contact your accounting supplier and see what steps they have taken to assist you with this increase.

Not sure what VAT you should be charging?

Take a look here at this link from the Government VAT Advisory Team - https://www.gov.uk/guidance/catering-takeaway-food-and-vat-notice-7091